Subscription in for-finances advanced schooling organizations continues to grow as the newest and you may going back college students find informative possibilities that fit within their existence, fueled partly of the paigns you to definitely imply that to possess-money colleges will quick tune both admissions process and also the program out-of study. People in addition to their family build huge investments in the advanced schooling zero amount what type of institution, however, those who sit in to own-profit establishments usually see little in the form of economic advantages. In addition, huge amounts of dollars when you look at the government loans would go to to own-profits from year to year; of all the people going to five-seasons for-funds associations in 202021, 62.dos percent was indeed government offer users, without doubt a beneficial testament that these types of establishments register a disproportionate amount of reduced-earnings students. Significant servings of government financing these colleges discover are utilized toward companies’ advertising work in lieu of education .

That it sandwich-par return on investment during the to own-money associations strikes women much harder than dudes because the undergraduate and you may scholar enrollment within having-earnings establishments was disproportionately women and reasonable-money . For-money pupils also are likely to getting earlier pupils , and people that before went to college and then discontinued their education and now have beginner mothers. Not simply was socioeconomically disadvantaged college students very likely to join the to possess-earnings business, the establishments by themselves sign up for and you may aggravate this type of downsides because of this new much lower return on the investment away from a diploma or credential from an as-money place, than the public and personal nonprofit organizations. Considering the disparate results of getting-earnings children, what makes by far the most insecure and marginalized students registering during the this type of establishments? A comparable gender, riches and money inequality you to forces people to follow higher education means they are subject to focused business and you may employment content. For-finances schools are recognized to regularly engage in focused employment and subscription out-of college students regarding color.

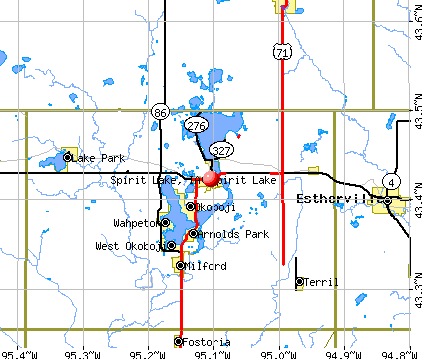

Focusing on advertising of higher-cost, low-well worth postsecondary applications so you can lowest-income youngsters and you will pupils out-of colour is commonly described as predatory addition. By locating on their own inside wide range-deprived communities, which in turn run out of most other postsecondary academic software, for-money universities do away with the geographical traps to school. As youngsters they serve may see this closeness since an effective immense benefit, the connection ranging from student and you will organization is almost certainly not entirely symbiotic . Youngsters from inside the reasonable-money, low-income groups-in addition to racialized minorities and people which have dependents-ount away from school funding, of which the fresh new to possess-finances place is also make funds. Children accept high levels of personal debt to have degrees very often, in the long run, don’t have a lot of payoff in their eyes but large monetary settlement to your knowledge vendor. And you may that happen to be the students probably become victimized of the predatory to own-cash organizations? Nearly one out of four student mothers sit-in private, for-profit associations. On the other hand, nearly one out of five regarding article-9/eleven GI Costs beneficiaries try enrolled in to have-profit organizations . It is value listing one as compared to Latine students gonna nonprofit organizations, those enlisted on to possess-cash institutions sense tough outcomes .

Black feamales in sort of statement a decreased loan benefits price getting education personal debt and declaration the greatest stress levels surrounding beginner loan fees

The brand new overrepresentation of women out-of color from the for-funds sector is very concerning considering their disparate small- and you may a lot of time-term higher education effects and may even end up being an adding factor so you’re able to the problem he has got in lowering the student obligations. The average Black education loan borrower reports a negative internet worthy of in their 30s although the typical white debtor has actually broken actually by then. Black individuals look for little or no reduced their education loan stability actually many years after entering installment.

If they standard to their funds, it affects their borrowing from the bank, and normally deal with many years of garnished wages, seized taxation refunds, let-alone complications borrowing to cover an auto otherwise home, and certainly will face next barriers if they attempt to sit-in yet another institution to end the Pennsylvania online installment loans degree

Recently, female are particularly many scholar knowledge readers. About informative season 202122, female acquired 62.six per cent out of master’s grade and you may 57 % of doctoral stages. Basically, female off colour is overrepresented one of advanced training recipients off having-finances universities-definition it disparately have the ill-effects out-of sub-par to own-cash apps. Subjects from predatory organizations usually are remaining that have immense personal debt burdens that simply cannot pay back. Luckily for us, plus settlements such as the you to described a lot more than, you will find debt settlement open to individuals who were defrauded because of the their place otherwise went to universities one finalized just before they finished the course of investigation .

Recent Comments