step 1. Look at the credit

Everything thereon report will you once you chat to their mortgage manager. It is preferable to take a look at your borrowing from the bank once all of the one year to make certain there aren’t any inaccuracies on the report.

2. Get home loan pre-approval

Next, decide which mortgage device is a knowledgeable fit for your position, after that shop additional lenders to see the one that contains the ideal conditions. Mortgage brokers shall be like useful here, because they run multiple lenders, and you may shop the loan around to find the best contract.

Receive the authoritative pre-approval page exhibiting manufacturers you are a serious consumer, you will need to tell you these records:

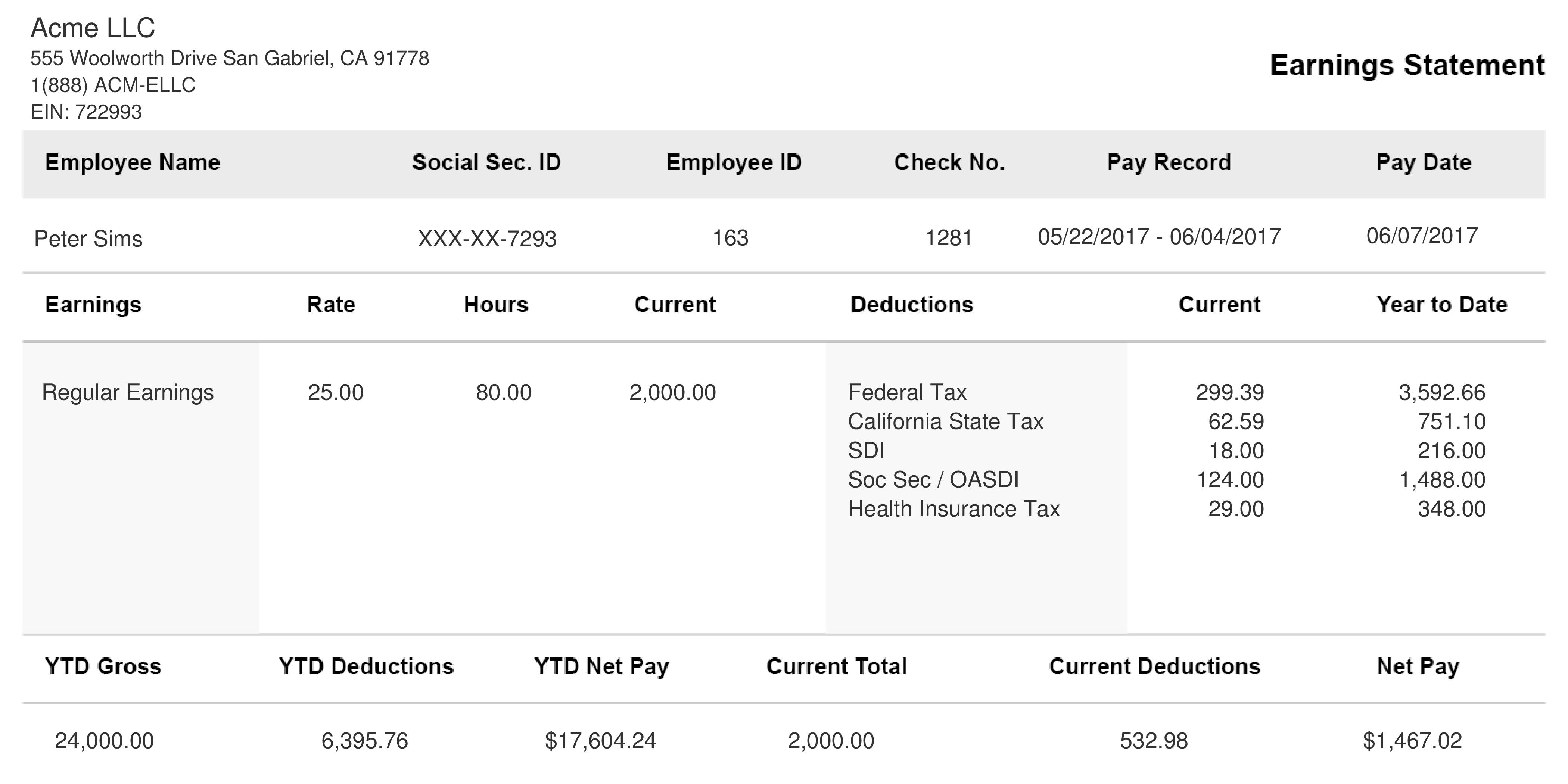

- 2 years out of W2s

- Shell out stubs over the past a few months

- Lender comments for the past a few months

- 2 yrs worth of tax returns

- Profit-and-loss comments to possess worry about-employed individuals

- Case of bankruptcy or divorce proceedings records (when the applicable)

Obtaining pre-approval letter is an essential part associated with the techniques. It generates one provides you with make towards possible homes far more effective, since it shows that debt details have already came across the latest minimum conditions necessary for your financial, and you may barring any problem through the underwriting, you will probably getting approved for funding.

step 3.Find a realtor

Select a great agent that is competent during the performing that have earliest-big date consumers near you. Their mortgage broker regularly works together tons of some other agencies, that will be well versed about what of these know your own target community most readily useful. First time buyers, pros, and you will higher-avoid home buyers will understand this particular expertise in settling agreements.

cuatro. Narrow down your local area

Finally, beforehand searching, narrow down the area we want to live in. Consider situations influenced by venue for example:

- distance be effective

- just how personal youre towards the facilities you love

- quality of nearby universities (even if you don’t have students)

- future advancements otherwise city considered

5. Discover your following home

Make use of a home applications and other beneficial devices so you’re able to stand planned, and you will browse home values in the area. Consider, this is perhaps not the last house possible own. It’s a start, and you will a stepping stone to build your upcoming guarantee with the.

Maintain your real estate means vs. wishes listing in your mind when you store, in order to maximize your to purchase fuel and continue maintaining expectations inside have a look at.

6. Make an offer

When you discover property you like, your broker will help you build a deal. The deal will inform the words on the home buy, the type of loan you’ll explore, and people merchant concessions you’re requesting.

Their agent makes it possible to pick if it is best if you ask having supplier concessions, just in case it’s better to depart them out, according to temperatures of the housing market, and you will level of almost every other offers the home might have.

Owner upcoming has got the solution to accept, deny otherwise bring good counteroffer. Often you will go back and onward from time to time which have the vendor before you could visited a binding agreement.

seven. Your own provide are recognized

After you and seller come to a binding agreement along with your give is theoretically acknowledged, youre thought inside deal.’ You will place a romantic date so you can to remain the new dotted range and intimate the deal.

8. Loan underwriting and you can Monitors

Now is the time to own underwriting, appraisals, and you can checks. There are many holding out during this period, also it may seem for example you’ll find nothing happening sometimes, however, much is going on behind-the-scenes to get the loan courtesy.

TIP: Pose a question to your mortgage coach in regards to the do’s and you will don’ts regarding escrow, so that you try not to occur to sabotage your residence financing by simply making good circulate your own lender would not approve regarding.

nine. Personal escrow

Since closure date nears you will give the income for any closing costs and you may deposit required by your financial, and you will indication the state records when deciding to take control of your home.

When you sign the mortgage files having a good notary, the lender will see people past left conditions and your file will be create so you’re able to number into county. Since the document is actually registered into the state, you are commercially a citizen!

10. Agenda a scheduled appointment.

Its as easy as scheduling a fast phone call otherwise ending up in one of our home loan advisors. In a few minutes, you will be aware what bad credit personal loans Oklahoma you are able manage, and ways to just do it.

Recent Comments