Countless People in america obtain personal loans so you can combine financial obligation, protection unforeseen expenses, handle home improvement ideas as well as start businesses. And even though its relatively easy to take out an individual financing, and you may a personal loan will likely be a substantial method of getting money rapidly (see the most recent personal bank loan cost here), it isn’t something which will be drawn softly and it will become high priced for your requirements. Listed below are half dozen some thing benefits state you need to know prior to taking out a consumer loan.

step 1. See the application techniques

To acquire an unsecured loan, you’ll fill in a credit card applicatoin and show evidence of their name, address and you may money. The financial institution will get ask for things such as W2s, spend stubs, 1099s, lender comments, taxation statements, electric bills, mortgage statements, license, passport and much more.

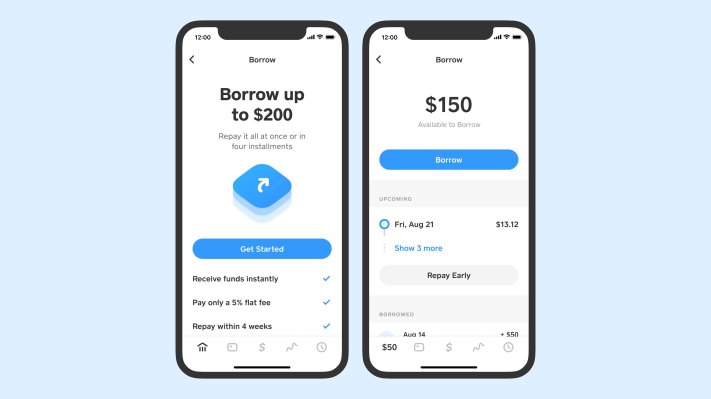

When you find yourself that may appear to be a great deal, thank goodness one signature loans tend to finance rather quickly. Signature loans bring a quick and easy software techniques, specifically compared to the extended, paperwork-filled contact with making an application for a home guarantee personal line of credit otherwise refinancing your own financial. It has been you’ll to try to get a personal bank loan online during the a few minutes so if you’re approved, you can buy the cash the very next day, states Ted Rossman, elderly business specialist within Bankrate. This guide can tell you ways to get an unsecured loan.

2. Thought other available choices

It’s necessary to know the additional options before getting a personal loan to make sure that it is your cheapest alternative. Oftentimes, promotion handmade cards or house security financial support may help you to accomplish your goals and you can help you save money, says Annie Millerbernd, consumer loan specialist from the NerdWallet. In fact, prices on HELOCs and house collateral funds are lower than personal loans. This guide highlights the differences between an excellent HELOC and you may home guarantee loan whenever you are considering one particular.

While using a personal loan to repay loans, you may find that sometimes, a loans management plan provided by a reputable nonprofit borrowing therapist includes more desirable terms and conditions than simply a personal loan – specifically if you have less than clean borrowing. The majority of people can be be eligible for something similar to good 5-season pay identity which have an excellent eight% interest when consolidating highest-cost credit card debt, states Rossman.

3. Understand where to find the best prices

On the internet loan providers – such as fintechs – often supply the greatest pricing, benefits say. However it is paydayloancolorado.net/jansen/ reasonable to add some typically common banking institutions and you can borrowing unions on your own search, also. Pricing differ such that you should obviously comparison shop aggressively for the best terminology, claims Rossman. (Comprehend the most useful consumer loan interest rates you can be eligible for right here.)

There’s absolutely no need to obtain a consumer loan with no knowledge of about what price to anticipate, states Millerbernd. Prequalify that have a lender prior to distribution a credit card applicatoin so you can preview the mortgage render. Because pre-being qualified will not affect your credit rating, you could potentially look around from the several loan providers before choosing one, says Millerbernd.

cuatro. Perform some homework on the other charge you can also happen

Research not merely at rate you will end up recharged, and in addition within charges. Instance, of numerous unsecured loans include a keen origination percentage, and that generally ranges from a single% to eight%. This is something you should use in the browse procedure since the your check around. Also, origination charge are often subtracted about loan amount, when you you want $ten,100000, but there’s a beneficial 8% origination fee, you ought to inquire about close to $eleven,100000, claims Rossman.

5. Recognize how personal loans work

A personal loan is actually a loan awarded of the an online financial, lender, or borrowing relationship, usually in a price ranging from throughout the $1,100000 in order to $one hundred,000; you usually pay off him or her within typical periods, including per month, more from one to eight years.

Unsecured loans usually are consumer debt, which means you typically don’t have to really lay a secured item particularly since your domestic otherwise car at stake as collateral. You can acquire the bucks in a single lump sum, and you will lenders generally aren’t one tight about what you need the money getting. Merely notice, if not pay off the mortgage, you are going to ruin your credit score.

That said, when you are having difficulty expenses a financing, discover era where you are able to take out an additional mortgage to aid repay the existing that. It makes sense if you can lower your interest, but keep in mind costs to originate this new financing, states Rossman.

six. Its impractical you’re getting struck which have a goverment tax bill as much as your own personal bank loan

Usually there are no taxation effects when you take aside a personal loan since it is maybe not felt income. For people who end up with an element of the mortgage forgiven otherwise terminated, merely upcoming really does you to amount become nonexempt just like the money, states Matt Schulz, head borrowing analyst in the LendingTree.

Counsel, information or score conveyed in this article are those off MarketWatch Selections, and possess not already been examined or endorsed because of the the commercial lovers.

Recent Comments