Two of Australia’s most significant finance companies provides relocated to control higher-chance domestic lending, given that regulator found it’s been warning certain associations so you’re able to scale back on high-risk loans.

Key points:

- APRA’s workplace shown the fresh regulator has contacted particular banking institutions in the a increase in the high-risk high financial obligation-to-income fund

- ANZ and you may NAB features recently imposed brand new, down limits for the instance financing

- The newest moves will reduce the most specific home loan candidates can also be acquire

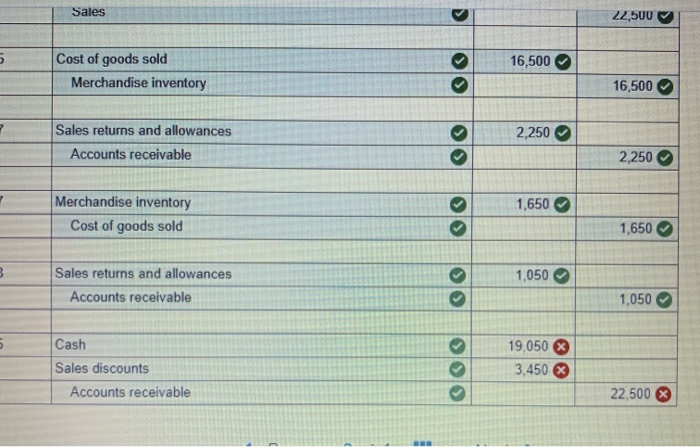

Recently, ANZ informed mortgage brokers as well as bankers those of June 6 it would don’t make fund in order to individuals who owe more than 7-and-a-1 / 2 of times their annual income.

These actions are responsible for decreasing the maximum count an excellent home customer otherwise someone refinancing can also be acquire from what had previously been you’ll.

A beneficial newbie’s help guide to home loans

“ANZ daily analysis lending cravings and you will guidelines as financial ecosystem change to be sure we are continuous to help you give prudently to the people,” a spokesperson with the lender informed ABC Reports.

Speaking from the AFR’s Financial Discussion, ANZ’s head regarding shopping financial, Maile Carnegie, a week ago said the alteration got simply held it’s place in reaction in order to issues throughout the banking regulator APRA towards ascending peak of money that have a good DTI ratio of greater than half a dozen, it takes into account high-risk.

Nearly a quarter of new loans got an effective DTI from half dozen or a lot more than about last half from last year, even if Ms Carnegie said few loans came near to ANZ’s earlier limit away from nine minutes income.

APRA alerts particular banking companies so you’re able to elevator standards

Talking in one financial meeting simply instances later, APRA chairman Wayne Byres verified the fresh new regulator got called particular banks which have issues about the level of higher DTI money these were providing.

“We’re going to also be enjoying directly the feel of individuals just who has lent in the higher multiples of its earnings a beneficial cohort having person significantly for the past year,” the guy advised the brand new AFR seminar.

“We thus registered to tackle our very own issues into the a bank-by-lender base, in lieu of choose for any style regarding macroprudential response.

“I expect credit rules changes in the those individuals finance companies, combined with ascending interest levels, will see the level of higher DTI credit beginning to moderate in the period in the future.”

Within the a created report, NAB administrator Kirsten Piper said the lending company is actually “invested in credit responsibly” to help you “verify customers are in a position to appropriately would their costs, both now plus the near future.”

“NAB continues to put responsible lending first in its means so you’re able to borrowing and in addition we allowed lingering consultation that have regulators.”

Westpac and you can CBA each other informed ABC Information they had not made latest transform on their regulations doing highest financial obligation-to-money proportion financing.

Westpac told you all the funds with a DTI away from seven or more is sent to have “guide review” from the its borrowing from the bank team.

The fresh ABC knows this step involves more capable bankers deciding on brand new applicant’s a career record, money as well as the quality of their protection (that’s, the newest valuation on the assets, particularly the mortgaged property) prior to often approving or declining the mortgage.

CBA told you money with good DTI or half dozen or greater and you will a high loan to well worth proportion are at the mercy of “stronger financing details”.

‘Pockets off stress likely’

APRA been broadening their vigilance up to household lending from inside the October last seasons, if it launched a rise in the minimum home loan serviceability barrier.

RateCity’s search movie director Sally Tindall asserted that change, together with rising rates, can get a bigger effect on how much cash loans in Snyder individuals is borrow.

“Debt-to-earnings percentages was one brief portion about serviceability formula. Ascending rates, particularly, are far more planning influence people’s domestic applications moving forward,” she informed ABC Reports.

The latest Reserve Lender try sure really borrowers can manage rising interest rates, but it also alerts current consumers will be support getting shedding possessions prices.

Mr Byres said this new regulator was not worried about the potential having extensive mortgage defaults across the banking business, nevertheless are alarmed that particular individuals, specifically current ones, is generally under really serious financial stress.

“The faster-than-questioned introduction away from high rising cost of living and you may rates of interest gets a good extreme impact on of several financial individuals, that have purse from stress most likely, especially if rates rise easily and you will, sure-enough, construction costs slip.

“Out of form of note will be home-based mortgage borrowers exactly who grabbed virtue of really low repaired rates over the past 2 years, and may also deal with a sizeable ‘repayment ‘shock’ (perhaps combined by bad guarantee) after they need re-finance next few years.”

Rate go up standard chance

Just like the rates increase, almost 3 hundred,100000 individuals who grabbed high and risky lenders inside pandemic you will definitely fall into major pecuniary hardship if not default.

Ms Tindall said the individuals dangers would be to lead to possible homebuyers so you’re able to think about how exactly far they are willing to acquire.

“While the banking companies will nevertheless approve fund with a loans-to-money proportion regarding half a dozen or more, considering they citation the brand new banks’ almost every other serviceability evaluation, individuals should be aware of this type of lending is regarded as risky from the the brand new regulator,” she told you.

“If you’re looking to obtain a special loan, you should never trust your lender to tell you the way much your can obtain. Workout what your monthly costs perform feel like if the prices flower from the doing about three fee facts plus consider just how much loans you take into the. Possessions costs can move up and down, however, that’ll not build your personal debt magically drop off.

Recent Comments