– Maria

The expression a reverse home loan? Commercially known as a home Guarantee Conversion Home loan (HECM), it is financing program specially available for elder home owners. This has been covered from the Federal Property Administration since the 1988.

According to Federal Trade Percentage, contrary mortgages functions by permitting home owners old 62+ to transform a fraction of their home equity for the bucks:

- Without the need to promote your house

- Without having to make month-to-month mortgage repayments (remaining latest which have possessions taxation, insurance rates, and you may repair necessary) unsecured personal installment loans in Albuquerque.

In place of a classic give home loan, where in actuality the borrower need begin paying down the borrowed funds immediately, a contrary mortgage appear owed merely pursuing the final debtor zero stretched resides in our home.

Watch this short videos to learn more aboutHow it really works

For many People in the us, their residence is the most significant asset, therefore the you to he’s invested one particular for the in their existence. Actually, domestic guarantee today means over a few-thirds of total money for the mediocre 65-year-old Western pair. dos Reverse mortgage loans performs by allowing people to help you utilize the residence’s equity if you are continuous to live there really towards the senior years years. Over 1.2 million Us citizens have generated an opposing home loan part of their advancing years package. step three Is starting to become best time to?

Contrary Financial compared to. Old-fashioned Financial

In terms of contrary mortgage loans and you will conventional mortgages, there are many parallels and you may differences. When you are traditional mortgage loans want individuals to make normal payments to your their financing equilibrium monthly for many years, contrary mortgage loans none of them borrowers and come up with one monthly financial payments step one .

Similarities:

- This new homeowner keeps name and you may possession of the house.

- This new homeowner is responsible for possessions fees, insurance rates, and you can repair.

- Loans are secured by the cards and deeds.

- Settlement costs to own a face-to-face financial act like those to have a classic (forward) home loan.

Differences:

- Opposite mortgages not one of them monthly home loan repayments to be generated. step 1

- The credit range getting a home Guarantee Conversion Home loan can never getting shorter; its going to increase through the years, irrespective of financing equilibrium otherwise family worthy of. cuatro

- The fresh borrower won’t be needed to pay off over their home is value if it’s sold (non-recourse loan), and you may pays a modest FHA insurance premium attain such professionals.

For each the latest Government Property Authority (FHA) guidance, there are many other variables regarding how a contrary mortgage really works. Property owners must utilize the assets as his or her prominent residence while keeping the house in the good condition. Consumers taking right out an opposing home mortgage are also required to receive 3rd-people FHA-acknowledged guidance in advance of closing.

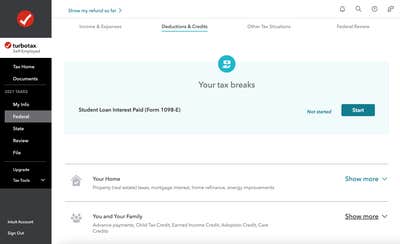

Do i need to Remove Monthly Mortgage repayments?

Sure. Which have an opposing mortgage, monthly mortgage repayments is actually optional, providing you keep current having assets fees, insurance coverage, and maintenance.

By removing month-to-month mortgage payments, you could improve cashflow. When you yourself have a current home loan, it would be paid-in full 1 -but you can however score an opposite financial even although you do not now have a mortgage.

One of the biggest advantages of exactly how contrary mortgages efforts are one to cost is actually deferred. Because of this repayment of one’s mortgage is not owed up to following the finally borrower don’t stays in the home. The possibility was your very own into although we need to pay off the borrowed funds ahead of time. There are not any prepayment punishment that have reverse mortgages. And with recommended mortgage repayments, step 1 you’ve got the independency to blow as little or as very much like you prefer, normally due to the fact you would like.

Exactly how Else Is Reverse Financial Bucks Be taken?

The bucks you will get away from a contrary mortgage can be utilized in any way you love. You will find several methods for finding loans and just how you use it money utilizes pension desires and personal financial predicament. If there is a preexisting home loan on the home, the money on HECM are very first familiar with repay the bill. The remainder finance will likely be consumed in the following the delivery steps:

For each homeowner varies, and you may our very own consumers discovered imaginative utilizing a reverse mortgage to improve its profits, life-style, and you may month-to-month earnings. These are simply some examples of just how reverse mortgage loans functions for the best:

Recent Comments