When you have plans to have property, offering, otherwise refinancing, it does most likely require an assessment. Just like the mortgage lender have a tendency to order the latest appraisal to make certain that they may not be issuing a loan for over just what home is worth, will still be perfect for customers and you will providers to understand the house assessment procedure as well as the different types of domestic appraisals that are offered.

Below are an overview of each type regarding appraisal and benefits and drawbacks of each and every. And so the next time you choose to buy a home otherwise mark from your own home security that have an earnings-away re-finance, and you can an assessment must finish the transaction, you can preserve these considerations in your mind.

Full House Appraisal

An entire household assessment is when a licensed appraiser inspects the fresh interior and you can additional off property. Appraisers working on a complete appraisal takes photographs and you will specifications of one’s subject property, offer commentary toward its most recent status, and you may contrast the square footage, number of bedrooms and you will bathrooms, and more so you’re able to equivalent attributes in your neighborhood having recently marketed. These are also known as equivalent features or possessions comps. Appraisers next make use of the sales price of people comps to aid determine the subject property’s worthy of.

A classic, full appraisal is exactly what most lenders explore before money home financing. Normally, this is thought more right, over way for determining good property’s economy worth.

- The lending company, client, and you can seller all get a precise review of house’s worthy of as a result of an authorized appraiser’s works.

- On client, it includes satisfaction to make certain that they’re not loans South Woodstock CT overpaying towards the house’s price.

- For the financial, simple fact is that extremely particular means to fix guarantee that he’s maybe not giving a mortgage for over precisely what the home is worthy of.

- Complete appraisals is also reduce the financial techniques if not managed safely.

- The full family appraisal cost is more costly than many other valuations, since it requires so much more performs out-of appraisers.

Drive-Because of the, or External-Simply, Assessment

Exterior-only appraisals, or drive-from the appraisals, are the thing that they appear to be. The new appraiser actually drives by topic assets and takes outside images without going during the domestic.

Then your appraiser spends readily available a property info and you will assets comps to find the house’s valuation. Having property purchase, the brand new appraiser may use list photo to ensure the advantages and status away from a property.

- You don’t need to to enter the house accomplish brand new appraisal, and work out arranging simpler.

- It has been done in re-finance facts if owner have a lot of equity home, so the re-finance techniques is also circulate quicker.

- Because appraiser doesn’t go into the domestic, there is lots to the that will get skipped, affecting the brand new valuation.

- Having fun with photographs offered by owner otherwise consumer might not portray the fresh home’s real standing, and you will distorted otherwise fraudulent images you can expect to artificially increase precisely what the house is definitely worth.

ACE+ PDR Report

The brand new Ace+ Property Study Report (PDR) is actually a different sort of model that enables eligible borrowers into Freddie Macrecognized mortgages to avoid the full assessment. As an alternative, assets information is amassed into-web site of the an agent, inspector, otherwise study enthusiast playing with Freddie Mac’s proprietary PDR datasets.

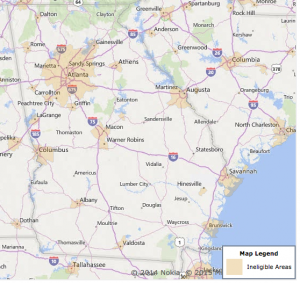

If Ace+ PDR choice is approved, and you can a beneficial PDR can be used to originate the loan, Freddie Mac computer will accept the newest estimated really worth recorded by the provider to possess underwriting the borrowed funds. Freddie Mac computer has been comparison some elements of their Adept+ PDR giving, and this bulletin traces the present day criteria and you will eligibility.

Kairos Appraisal spends educated investigation debt collectors to provide Expert+ Assets Studies Account one hold the Freddie Mac computer PDR studies set. There are more information inside our blog here.

AVM (Automatic Valuation Model)

An automatic valuation design is actually a utility that uses an algorithm to help you determine a property’s well worth. Various AVMs are available, and each might provide yet another valuation. You can find AVMs to possess mortgage lenders and real estate agents, and those that anyone can supply, including Zillow’s Zestimate, a well-known analogy.

An AVM appears having an approximate household worthy of from the comparing the values from equivalent attributes in one day and age. It takes into account factors particularly venue, square video footage, and more without needing an expert assessment or to the-website review.

Kairos Reinvents new Appraisal Processes

From the combining data statistics, leverage geocoding, using reducing-border arranging tech, and using interactive interaction gadgets, there is given the appraisal procedure a whole overhaul. These are merely some of the implies we have been altering the fresh antique assessment processes. Should you want to discover more about partnering having Kairos Appraisal since your common AMC, click the link to connect with our team. If you have questions towards different kinds of domestic appraisals, reach out to you whenever.

Recent Comments