Avoid bringing trapped purchasing a few mortgage loans when selecting your next home.

If you plan to sell your property and buy a separate, which ought to you will do very first? If you offer first, you are under-time stress to track down another family quickly-and will find yourself settling for less than you desired, overpaying, otherwise being forced to content on your own and all your personal property for the a hotel room unless you can acquire a unique put. However,, if you purchase earliest, you will have to scramble to sell the old house-a certain disease if you need to rating a high price toward the newest marketing to produce the fresh new deposit into new one.

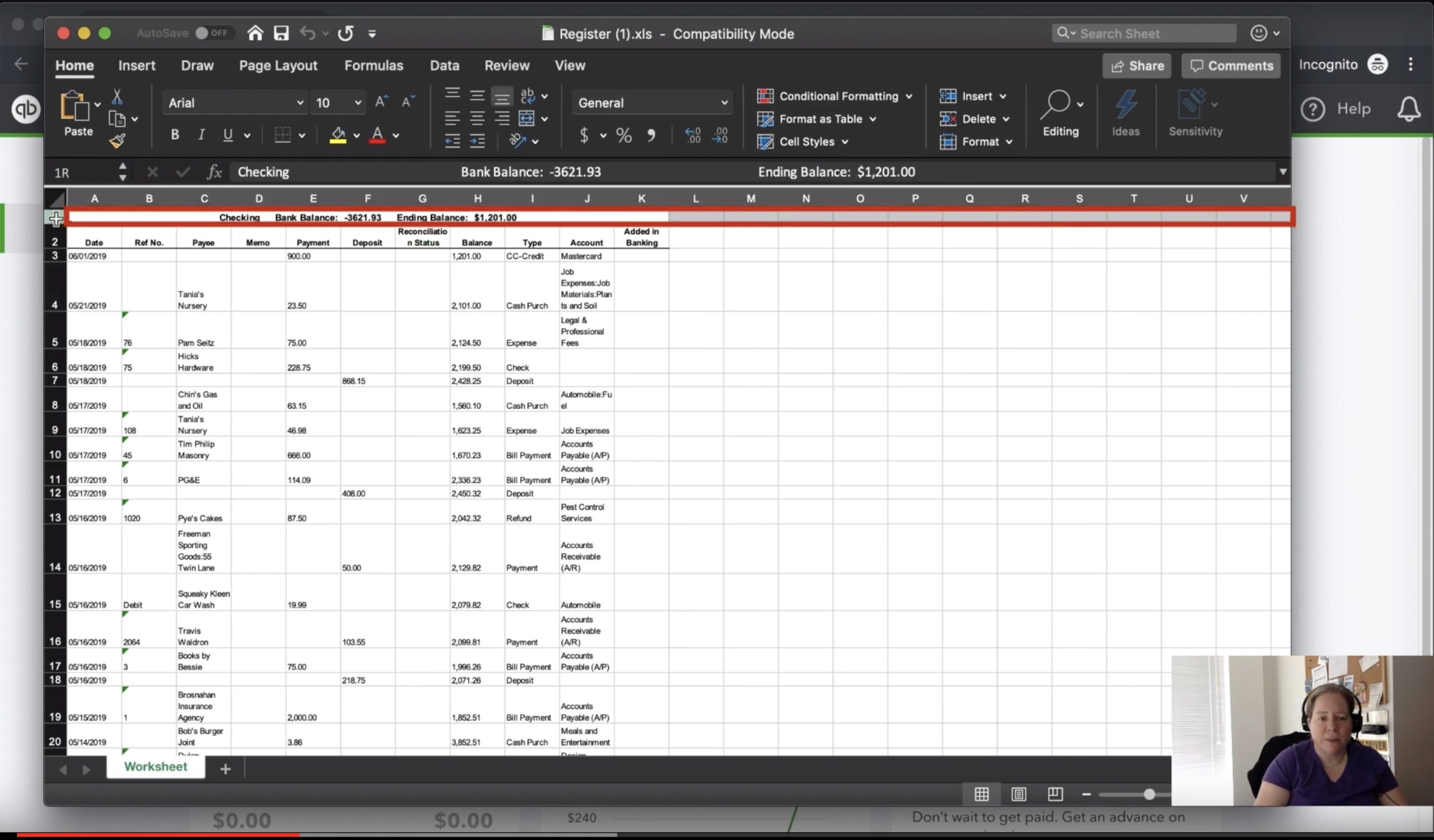

Managing a few houses at once isn’t any eradicate, either, although its for a short time. You will have to value a couple of mortgages-in the impractical enjoy one to a loan provider is also willing to provide you with home financing to own another home prior to you ended up selling the initial-including twice the constant maintenance, and also the protection problems that have making one family empty.

Make Property Market’s Heat

Prior to placing your home on the market or committing to buying a different one, check out the the prices off house regarding places where you will be each other exchanging. To help you learn how to promote large and buy lowest, you need an authentic idea of simply how much equivalent properties is choosing.

And work on whether or not the local real estate market try “hot” (likes providers) otherwise “cold” (favors people). Just like the you’re one another a purchaser and a vendor, you will have to cover yourself on your own weakened character to make one particular of your own more powerful character.

If the market is cold, you are in a healthier status because a purchaser than just because the an effective supplier. You might have got their get a hold of out-of lots of houses offered, during the low prices. However you may have issues attempting to sell your. To safeguard oneself, you could start by buying an extra domestic, however inquire the vendor to make your purchase contract contingent up on their offering your current domestic. A provider which have a tough time wanting a buyer is probable to simply accept so it backup, even though it means waiting for you to find a purchaser. Anticipate to give the provider possible good reason why your residence will promote easily.

But if no merchant try ready to take on that it backup, but not, no less than make sure to is plan financial support. Talk to a large financial company about what you can easily be eligible for. After that anticipate to work easily to put your first home on the market after going ahead having purchasing an extra one to. There’s a lot you are able to do ahead, for example taking care of fix points, dealing with records on the means guides and other data it is possible to give the visitors, going for a representative and perhaps property stager, etc.

Procedures inside an excellent Seller’s Market

During the a trending field, promoting your property are going to be convenient than simply to purchase a separate one to. To ensure that you you should never become home-faster, you might want to start by interested in a home in order to purchase, up coming make sufficient cash-by using the steps discussed lower than-to wave your over into the allegedly little while the place you individual two houses immediately.

If you cannot move such as for instance an arrangement, although not, you could negotiate with your home’s buyer to have the selling bargain are a provision deciding to make the closure contingent on your own looking for and closure toward a different sort of home. In the event partners people often agree to an unbarred-finished several months, some was so desperate to buy your house that they’ll invest in slow down the fresh closure until you intimate toward an alternate house otherwise up until a certain number of weeks ticket, any type of comes very first.

Be also bound to completely research the market one which just sell, to ensure you’re going to be a competent client, who is going to offer the proper rates into glamorous terminology.

Link Resource: How exactly to Individual Two Domiciles Briefly

What if you might be incapable of well dovetail the selling of just one house with the acquisition of another? You might very own zero domiciles for some time, in which case you should have profit the bank and can you want a short-term place to real time. Or you might individual a few property immediately. The following advice is always to help you manage eg juggling serves:

For those who have household members who possess enough free dollars to make investments, them financing you money you’ll serve both its welfare and you will your personal, particularly if you offer to spend a competitive rate of interest. Claim that you want help for only a short period, too. Allow the people deciding to make the mortgage an effective promissory note, covered by a second home loan (deed out-of trust) on your new house. You will need to install it to make sure that zero monthly payments is actually owed up until your first house sells. Getting informed, although not, one to based on the money you owe, institutional mortgage lenders you are going to decline to approve that loan where in fact the downpayment does not come from your own info.

Get a connection financing out-of a lender

If you have hardly any other alternatives, it could be possible in order to borrow cash of a lender otherwise other lender so you can bridge that time anywhere between after you romantic towards the the new home whenever you get your money from the profit of one’s old you to. This idea is that you remove a short-name loan on the established family, using it towards this new deposit and you may closing costs in your new home, and you can repaying they if for check this link right here now example the basic home sells.

Bridge finance can be, however, feel alot more costly than simply normal mortgage or family security money (highest initial repayments together with interest levels), and perhaps they are challenging so you’re able to qualify for. Needed enough collateral on your newest house and you may enough income to expend each other mortgage repayments indefinitely. The needs all but negate the great benefits of the borrowed funds.

Recent Comments