Just like the initial receipt of the restricted contribution, the investment income earned on these endowment funds, which is restricted for long-term purposes, must be reported as a financing activity. Also, when using the indirect method of reporting cash flows, cash flows from operating activities will need to be reduced by the amount of investment income received with long-term purpose restrictions, since the investment income is included in the change in net assets, which is an operating activity. LesseeA lessee is required to present ROU assets resulting from finance leases separately from ROU assets resulting from operating leases and separately from other assets, either on the face of the balance sheet or in the footnotes.

Leveraged Leases

Entities are also required to provide an explanation to users of financial statements about which practical expedients were used in transition. If a seller-lessee enters into a sale and leaseback transaction, it must provide the disclosures required for lessees. Additionally, a seller-lessee must disclose the main terms and conditions of the sale and leaseback transaction and must tax deductions guide 20 popular breaks in 2021 disclose any gains or losses arising from the transaction separately from gains or losses on disposal of other assets. For finance leases, a lessee should present the interest expense on the lease liability and amortization of the ROU asset in a manner consistent with how the lessee reports other interest expense and depreciation or amortization expense in the income statement.

Disclosure

Similarly, lease liabilities for finance leases are required to be presented separately from lease liabilities from operating leases and from other liabilities. In addition, ROU assets are presented as noncurrent in the lessee’s balance sheet, consistent with how other amortizing assets such as PP&E are presented. However, the related lease liabilities are subject to current and long-term presentation requirements in a classified balance sheet, consistent with the way other financial liabilities are presented. Noncash investing and financing activities that are unique to not-for-profit entities include contributions of (1) property and equipment, (2) beneficial interest in trusts and (3) marketable securities. Just like all other noncash investing and financing activities, these activities, unless nearly immediate converted to cash, are not reported as operating, investing or financing activities, and instead, are reported in a separate disclosure either on the face of the statement of cash flows or in the notes to the financial statements. Although the majority of the disclosures required by ASC 842 only affect an entity’s annual financial statements, the new standard requires that lessors provide a table disclosing lease income for each interim and annual reporting period[3].

Agency Transactions

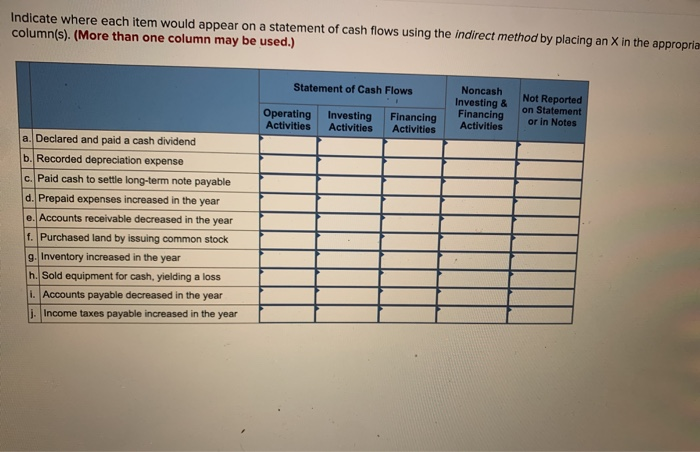

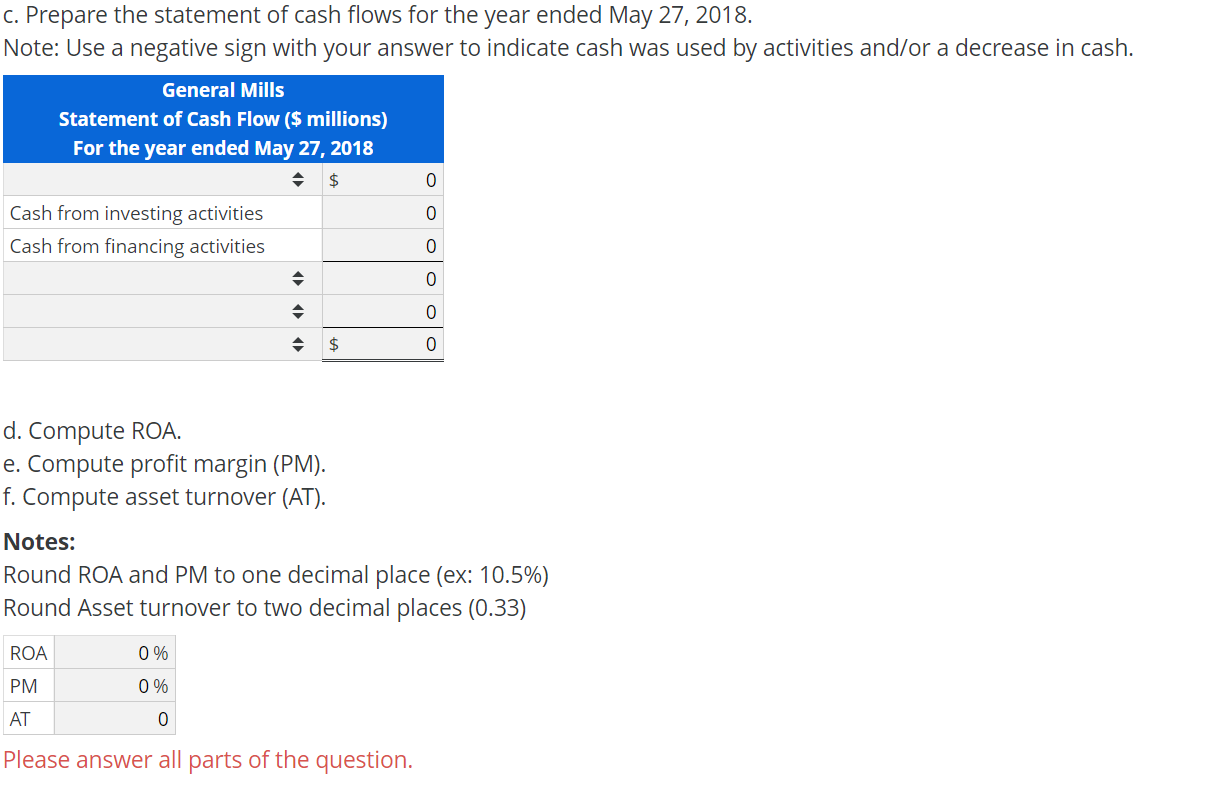

The entities falling under the Smith & Howard brand are independently owned and are not liable for the services provided by any other entity providing services under the Smith & Howard brand. Our use of the terms “our firm” and “we” and “us” and terms of similar import, denote the alternative practice structure conducted by Smith & Howard PC and Smith & Howard Advisory LLC. Both options A and C are cash activities that would be reflected on a company’s cash flow statement.

Smith & Howard PC and Smith & Howard Advisory LLC, practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations and professional standards. Smith & Howard PC is a licensed independent CPA firm that provides attest services to its clients, and Smith & Howard Advisory LLC and its subsidiary entities provide tax and business consulting services to their clients. Smith & Howard Advisory, LLC and its subsidiary entities are not licensed CPA firms.

When the funds are transferred to the third party, the payment is recorded as a reduction in the liability account. The receipt and disbursement of agency transactions are reported as an operating activity on the statement of cash flows and can be reported either at net or gross when using the indirect method of reporting cash flows. Some SEC registrants have questioned whether they must recast all periods reflected in the 5 year Summary of Selected Financial Data in accordance with the new leasing standard? Registrants are only required to adjust the periods in the financial data table that correspond to the periods adjusted in the registrant’s financial statements.

Income arising from leases should be presented separately in the income statement or in the footnotes. If presented in the footnotes, a lessor must also disclose which line items include lease income. Revenue and cost of goods sold related to profit or loss on leases recognized at the commencement date should be presented on a gross basis if the lessor uses leases as an alternative means of realizing value from goods that it would otherwise sell. If the lessor uses leasing as a means of providing finance, profit or loss should be presented on a net basis (i.e., as a single line item). During deliberations for the standard, many users indicated that the existing disclosure requirements did not provide sufficient information to understand an entity’s leasing activities. As a result, the new standard also introduces an overall disclosure objective together with significantly enhanced presentation and disclosure requirements for leases.

- Some SEC registrants have questioned whether they must recast all periods reflected in the 5 year Summary of Selected Financial Data in accordance with the new leasing standard?

- Entities are not required to repeat disclosures if the information is already presented in the financial statements as required by other accounting standards.

- Companies using the indirect method have to disclose cash paid for interest and income taxes, since those numbers are not apparent on the face of the statement as they were under the direct method.

Although certain of the retail locations are currently under construction, we do not control the building during construction, and are thus not deemed to be the owner during construction. Given that the transaction didn’t involve cash, it would have no effect on the cash flow statement. Below, you’ll find guidance on how to report these transactions that are unique to not-for-profit entities. Companies using the indirect method have to disclose cash paid for interest and income taxes, since those numbers are not apparent on the face of the statement as they were under the direct method.

These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. Issuance of common stock in relation to the conversion of preferred stock is an example of a non-cash activity. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. You can set the default content filter to expand search across territories.

Additionally, disclosure of which line items in the statement of financial position include the ROU assets and lease liabilities would be required. Entities must make appropriate disclosures for each annual reporting period for which a statement of comprehensive income (statement of activities) is presented and in each year-end statement of financial position. Entities are not required to repeat disclosures if the information is already presented in the financial statements as required by other accounting standards. An agency transaction is a type of exchange transaction whereby the not-for-profit entity receives funds that it must pass onto a third party. The receipt of these funds are not reported on the statement of actives, but instead, are reported as a liability on the statement of financial position.

Congrats on reading the definition of non-cash investing and financing activities. We have also not presented a statement of comprehensive income, but have assumed that Susie’s has presented Cost of sales, SG&A expense, Depreciation and amortization expense, and Interest expense.This example assumes that the guidance in ASC 842 has been in effect for all periods presented, and that all amounts are in millions. As of December 31, 20X9, we have entered into eight leases for additional retail locations and one lease for an additional warehouse which have not yet commenced.

Recent Comments