Virtual assistant Financing Recommendations

For many service users and you can experts whom meet the requirements, a good Virtual assistant financing is considered the most the most effective positives and a no-brainer more than a timeless mortgage. For folks who be considered, you can buy otherwise create property or re-finance a preexisting financial with as little as $0 down, great rates and capital without mandated cap.

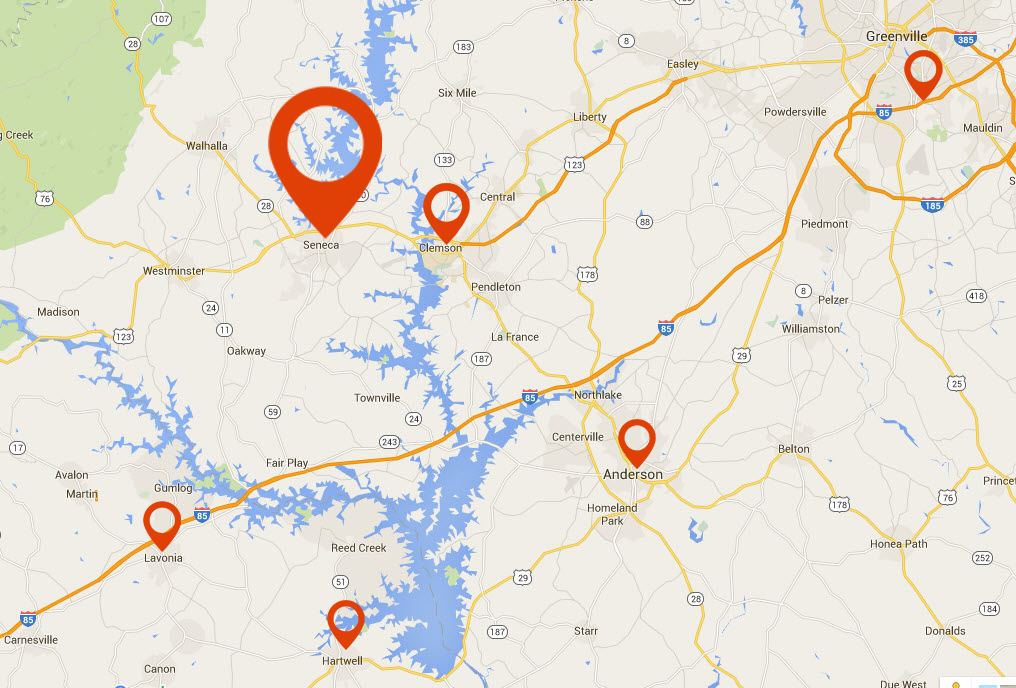

Which area has actually pointers and answers to popular questions regarding Va Financing benefits. Rating important info, and acquire contact info for regional financing centers.

Experts and you will services professionals should satisfy borrowing from the bank, money or other standards lay because of the Va plus the lenders that actually build such loans. There was a selection of methods experts may take to place themselves from inside the great updates to optimize their Va financing gurus.

Qualities from Successful Va Homebuyers.

- Credit rating – Virtual assistant borrowers should see good lender’s lowest credit score needs. That standard is typically lower than what needed for each other traditional and you can FHA finance.

- Compliment personal debt in order to income proportion – The brand new Virtual assistant essentially desires your debt in order to income ratio in the otherwise less than 41%, but it’s you can easily occasionally to help you go beyond one to endurance and you may obtain investment. When it comes to those times, the fresh new experienced is usually going to need to satisfy most conditions.

- A position and earnings – Lenders want to make sure you can afford the borrowed funds commission, along with other month-to-month essentials. Also searching for facts that your particular earnings is actually secure, legitimate and you can probably keep.

- Cash on hands – The fresh solitary biggest advantageous asset of Virtual assistant money ‘s the power to purchase property no currency off. Very Va people make use of this significant monetary chance. However, successful Virtual assistant individuals will get some money easily accessible to help you start the procedure.

- Are pre-acknowledged – Getting pre-approved getting a good Va financing was a serious action. Your own pre-approval letter will give you an obvious sense of your own purchasing fuel. It will also reveal vendors and real estate agents you’re a significant homebuying candidate.

Sure, you can aquire a house making use of your Va financing gurus whenever you are overseas. Remember you will find several rules in place to safeguard your very own recommendations. Providing a power regarding attorneys that may control your family get when you are out will help improve the procedure.

Deciding in which to stay armed forces houses or to pick your house is tricky. There are a great number of facts you will need to just take on the membership before making the decision. There are many different positives and negatives to consider. Our military houses vs. house purchase guide can present you with specific direction, and you will hopefully it’s going to make your decision some time smoother.

Exactly how many Virtual assistant finance must i loan places Libertyville keeps at the same time?

You can get more than one Virtual assistant mortgage but it’s maybe not popular. Armed forces reassignment is the most well-known cause of numerous Virtual assistant fund. Whether your Va homeowner keeps Virtual assistant mortgage entitlement (second-tier entitlement) the newest Virtual assistant will usually enable it to be one minute where you can find be obtained up to the rest entitlement amount. Veterans still need to meet the requirements.

The Virtual assistant loan payment per month are different according to household get speed, interest rate, deposit, credit history plus home place. We have written a user-amicable Virtual assistant finance calculator getting a crude guess of one’s rates malfunction four weeks.

Should i re-finance my Virtual assistant financing?

Sure, obviously you can re-finance your Va loan! There are many Va mortgage refinance apps offered, for instance the cash out refinancing system and the improve re-finance option.

Va Financing Re-finance Options

- Cash out refinance substitute Virtual assistant or traditional mortgage which have an effective Virtual assistant loan. An option to change family collateral to help you bucks. You need a cash-out refinance loan so you’re able to combine obligations, build home improvements, purchase university or get property.

- Streamline refinance, referred to as the speed Reduction Refinancing Financing (IRRRL), allows both active solution people also veterans so you can re-finance its Virtual assistant mortgage with the least quantity of troubles possible. It is a quick and you will sensible way to re-finance their Va loan without credit rating requirements, income verification otherwise family savings verification.

Va Fund: What you need to Know

Va finance generate property economical for many veterans and you may energetic provider people. Discover everything you need to find out about Virtual assistant Loan Apps.

Recent Comments